HK Virtual Banking Licensed Service Provider | PAObank

PAObank was granted a virtual banking licence by HKMA and all eligible deposits are protected by the DPS in Hong Kong. Enjoy fast and secured online banking today.

PAObank– One of the New Banks with a Virtual Banking License in Hong Kong

What is a virtual bank? The set-up of banks with virtual banking licenses is a new trend in Hong Kong, if not the world. A virtual bank can be defined as a bank which primarily delivers retail banking services through the internet or other forms of electronic channels instead of physical branches. In many worldwide regions such as countries of the European Union, the US and Asia, advanced virtual banks have been introduced to save the hassle of using the traditional banking service. To most of us, it is a time saving and efficient alternative for handling the money.

In Hong Kong, all virtual banks have to obtain a virtual banking license. This is one of the new initiatives of the Hong Kong Monetary Authority (HKMA), to start a new Smart Banking Era. With the introduction of the virtual banking licenses, non-traditional financial services providers can enter the Hong Kong banking sector with only virtual services without the requirement of physical branches. To obtain a virtual banking license, the companies must meet the requirements as set by the HKMA. Virtual banks are subject to the same set of supervisory requirements applicable to conventional banks.

PAO Bank Limited (PAObank) is one of the 8 banks with a virtual banking license. It is a wholly-owned subsidiary of Lufax Holding Ltd. and a member of Ping An Insurance (Group) Company of China, Ltd. PAObank aims to provide convenient and efficient banking services for retail customers and small and medium-sized trade enterprises (SMEs) in Hong Kong. It also enhances the financial inclusion in Hong Kong by providing 7 x 24 banking services with lower costs.

PAObank incorporates cutting edge technologies like artificial intelligence, blockchain, cloud platforms and biometrics identification to enhance users’ experience and provide an alternative to the conventional banking process. The characteristics of PAObank include relatively lower costs and charges, quicker handling process, fast response and high security.

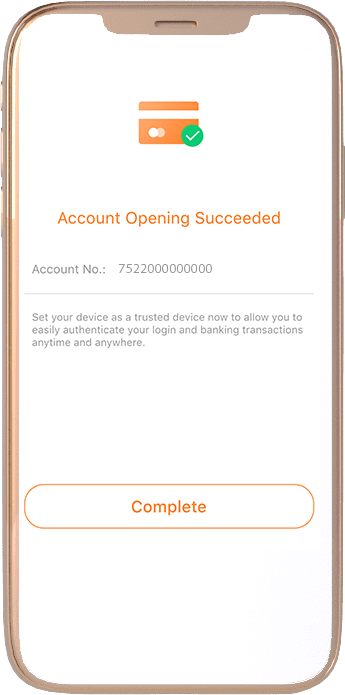

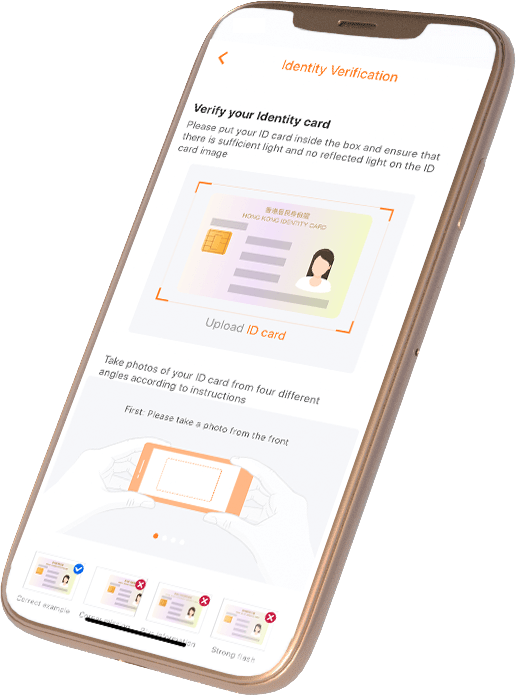

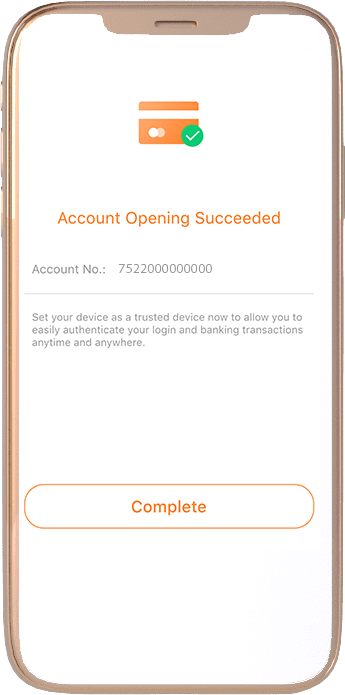

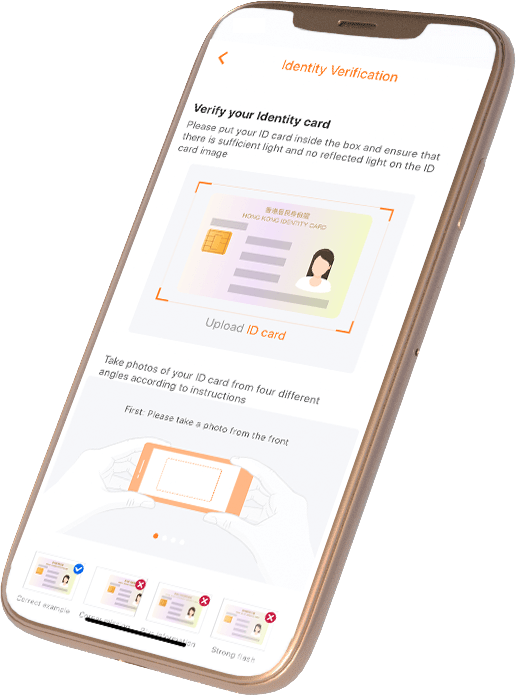

To opt for PAObank services, it is as simple as just touches with your fingertips. PAObank allows mobile account opening through the PAObank APP, a secure platform with login authentication. It takes only a few steps : 1) users have to input and verify their mobile numbers, 2) set up your account name and password, 3) ID card verification, 4) take self for biometric identification and 5) input and confirm personal information. This fully eradicates the complicated procedure of account opening in conventional banks and bring a new and efficient way to open accounts in minutes.

The savings account of PAObank is easy to open and manage. Clients can enjoy a basic saving interest rate of 1% p.a. (for account balance at HK$1M or below / 0.01% p.a. interest rate will be applied for account balance over HK$1M). There are NO fees and NO minimum account balance requirement. Selected customers who open open and activate a savings account could enjoy the benefits.

With the development of virtual payment systems, PAObank savings account can also be used as an Faster Payment System(FPS) account. Simply register through the APP and enjoy safe, secure and instant cross-bank transfers without fees. Both inward and outward payment through FPS do not incur any charges. This brings revolutionary enhancement of bill paying and transferral of money between individuals. Download the PAObank APP now and start the exceptional experience of online banking at your fingertip.

Don’t want to follow

the 9-to-5 banking hours?

-

7x24 all year long

7x24 all year long

-

Easy online self-service

Easy online self-service -

Fast account opening, lending & fund transfer (FPS)

Fast account opening, lending & fund transfer (FPS) -

Meet your needs anytime & anywhere

Meet your needs anytime & anywhere

Don’t want to follow the 9-to-5 banking hours?

-

7x24 all year long

7x24 all year long

-

Easy online self-service

Easy online self-service -

Fast account opening,

lending & fund transfer (FPS)

Fast account opening,

lending & fund transfer (FPS) -

Meet your needs anytime & anywhere

Meet your needs anytime & anywhere

We have nothing to hide,

except your privacy.

-

No minimum balance requirement

No minimum balance requirement -

No account maintenance fee

/ any other hidden charges

No account maintenance fee

/ any other hidden charges

Hard to choose between fast and safe,

why not both?

-

Secure login authentication

Secure login authentication -

Automated check of your device’s

security

Automated check of your device’s

security -

All eligible deposits are protected by the

Deposit

Protection

Scheme (DPS) in Hong Kong

All eligible deposits are protected by the

Deposit

Protection

Scheme (DPS) in Hong Kong

SERVICES

Retail

Retail

Enjoy hassle-free banking services to help you manage your finances easily.

More on Retail Banking  SME

SME

Get efficient, convenient and safe services to help you grow your SME business.

More on SME BankingDOWNLOAD

Google Play and the Google Play logo are trademarks of Google LLC.

HUAWEI EXPLORE IT ON AppGallery and the HUAWEI EXPLORE IT ON AppGallery logo are the registered trademarks of Huawei Technologies Co., Limited.

NEW UPDATES

Retail Banking News

Coming soon..

SME Banking News

Coming soon..

Promotions

Coming soon..